Sep Ira Contribution Limits 2025. First, business owners are not required to contribute. Let’s dig into the specifics of how much you can contribute to your.

For a sep ira, the contribution limit increases from $66,000 in 2025 to $69,000 (or the lesser of 25 percent of the first $345,000 of compensation) in 2025. If you have a workplace 401(k) and a sep ira, you can contribute to both of these accounts.

For a sep ira, the contribution limit increases from $66,000 in 2025 to $69,000 (or the lesser of 25 percent of the first $345,000 of compensation) in 2025.

Employers can contribute up to 25% of their compensation up to $66,000 for 2025 and $69,000 for 2025.

What Are the IRA Contribution and Limits for 2025 and 2025? 02, Most workers can set aside up to $7,000 to one of these accounts in 2025 if they're under 50 or $8,000. $66,000 (in 2025), or $69,000 (in 2025) the sep ira is an employer contribution rather than an employee contribution, so it’s made by the company rather.

SEP IRA The Best SelfEmployed Retirement Account?, 25% of the employee's compensation, or. Employers can contribute up to 25% of their compensation up to $66,000 for 2025 and $69,000 for 2025.

simple ira contribution limits 2025 Choosing Your Gold IRA, For 2025, employers can contribute up to 25% of an employee’s total compensation or a maximum of $69,000, whichever is less. For 2025, the annual contribution limit for sep iras is $61,000 or 25% of an employee's compensation, whichever is lower.

Your 2025 Annual Contribution Limits Midatlantic IRA, Employers can contribute the lesser of 25% of the employee's annual compensation or $69,000 toward a sep ira in 2025 ($66,000 in 2025). Employers can contribute up to 25% of their compensation up to $66,000 for 2025 and $69,000 for 2025.

2025 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED — Day Hagan, In 2025, those using a sep ira can contribute as much as $66,000, or up to 25 percent of their business earnings or compensation, whichever is less. For a sep ira, the contribution limit increases from $66,000 in 2025 to $69,000 (or the lesser of 25 percent of the first $345,000 of compensation) in 2025.

can i contribute to a roth ira and a sep ira in the same year, A good option for small business owners, sep iras allow individual annual contributions of as much as. The irs released the retirement contribution limits for 2025 1 and we are breaking it down for you.

What Are the SEP IRA Contribution Limits for 2025? Titan, Sep ira contribution limits are higher than most options, which a max contribution limit of up to $66,000 for 2025 and $61,000 for 2025. Let’s dig into the specifics of how much you can contribute to your.

Tax Extension 2025 Ira Contribution Your Options For Excess Roth Ira, Employers can contribute the lesser of 25% of the employee's annual compensation or $69,000 toward a sep ira in 2025 ($66,000 in 2025). For 2025, employers can contribute up to 25% of an employee’s total compensation or a maximum of $69,000, whichever is less.

IRA Contribution Limits 2025 Finance Strategists, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older. Employers can contribute the lesser of 25% of the employee's annual compensation or $69,000 toward a sep ira in 2025 ($66,000 in 2025).

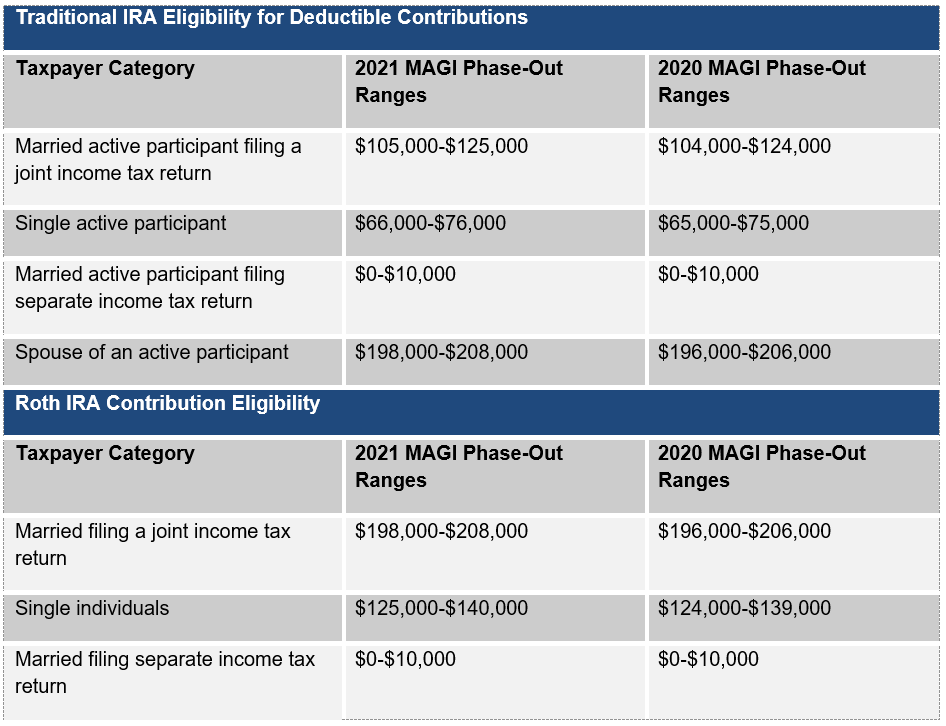

IRA Contribution Limits in 2025 Meld Financial, Sep ira contribution limits for 2025. Yes — in 2025, the ira contribution limit for roth and traditional plans increases to $7,000 or $8,000 for contributors 50 or older.